Shipping thousands of packages monthly? You’re choosing between USPS, UPS SurePost, and FedEx Ground Economy.

These economy shipping options look similar. They perform very differently.

The stakes: Pick the wrong ecommerce shipping service and you’ll see shipping costs jump 30-40% in specific scenarios. Or add 3-5 days to delivery times. Both kill customer satisfaction and repeat purchases.

Shipping costs eat 15-25% of product cost for most DTC brands. Carrier selection is one of your highest-leverage decisions.

This guide covers pricing structures, real delivery speeds by zone, dimensional weight traps, and recommendations by brand size.

We focus on economy and hybrid services — not premium Ground or Priority Mail.

For brands shipping 2,000+ orders monthly: We’ll cover carrier diversification strategies, including alternatives like GoBolt Parcel that can deliver 20-65% cost savings with 3-4 day transit times.

TL;DR: Which Service Fits Your Brand?

USPS Ground Advantage

Best for lightweight packages under 1 lb and low-volume brands.

Usually the cheapest for small items. Advertised at 2-5 business days but often runs slower on long-distance or rural routes. Fewer scan events than private carriers.

UPS SurePost

Works for mid-size DTC brands shipping 1-5 lb packages with negotiated rates.

More economical than UPS Ground for residential. Advertised 2-7 business days. UPS handles pickup, USPS delivers—which creates potential scan gaps and variability on rural routes.

FedEx Ground Economy

FedEx’s economy residential option. Best for brands already using FedEx Ground.

Marketed at 2-7 business days. FedEx manages most of the route and last-mile. Dimensional weight pricing still penalizes bulky, lightweight items.

Alternative carriers starting at 2k monthly orders:

Evaluate carriers like GoBolt Parcel for carrier diversification. Case studies show 30-45%+ savings and 3-day average delivery. Carbon-neutral options. Strong for brands prioritizing consistency, sustainability, or reducing reliance on hybrid services.

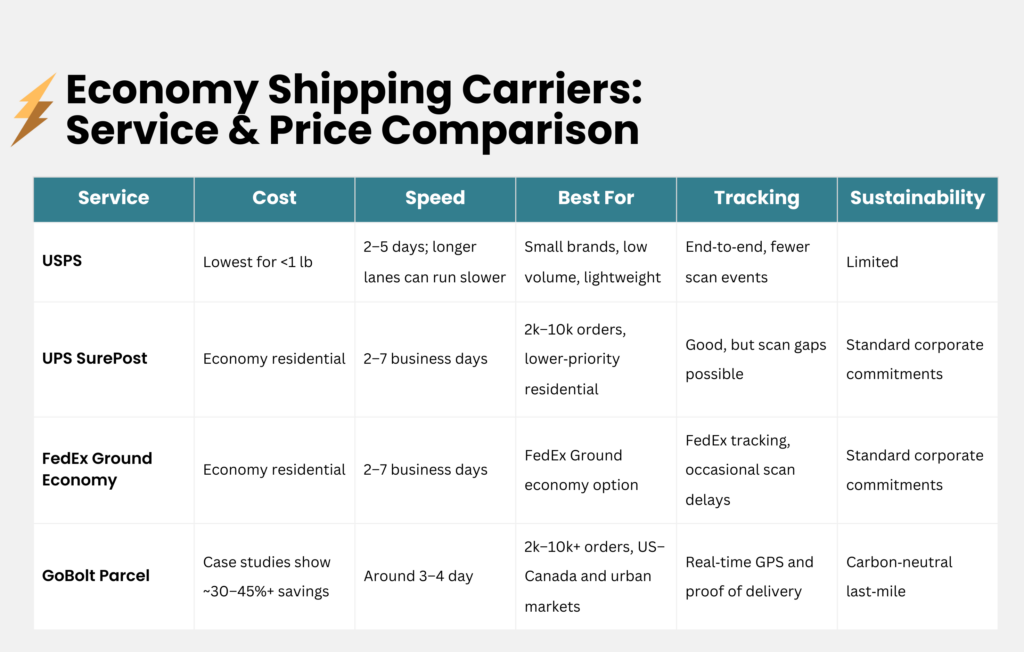

Economy Shipping: Quick Comparison

Service | Cost | Speed | Best For | Tracking | Sustainability |

USPS | Lowest for <1 lb (Commercial Pricing) | Advertised 2-5 days; longer lanes run slower | Small brands, lightweight items | End-to-end but fewer scans | Limited |

UPS SurePost | Economy residential; cheaper than Ground with contract | Advertised 2-7 days | Brands with 2k-10k orders needing economy residential | Good, scan gaps during USPS handoff | Standard commitments |

FedEx Ground Economy | Similar to SurePost and Ground | Advertised 2-7 days | Brands using FedEx Ground | FedEx tracking throughout | Standard commitments |

GoBolt Parcel | Case studies show ~30-45%+ savings | 3-4 day average in high-density lanes | 2k+ orders, US-Canada, urban markets | Real-time GPS + proof of delivery | Carbon-neutral EVs |

USPS: The Baseline Option

USPS handles both pickup and delivery. No carrier handoffs.

It reaches every US residential address. That sounds perfect until you check actual performance.

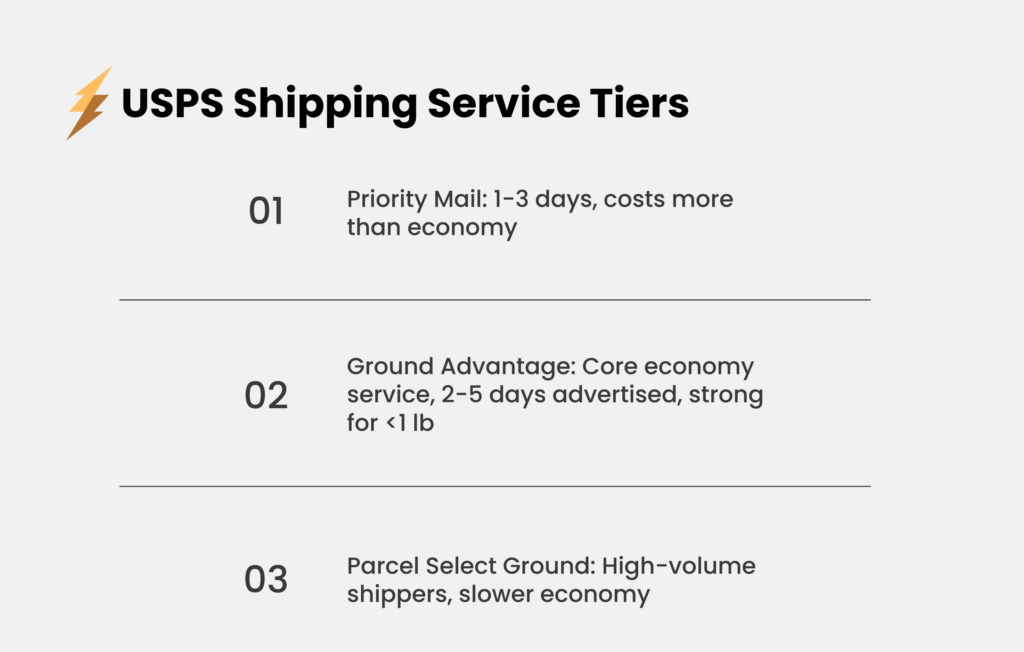

Service lineup:

- Priority Mail: 1-3 days, costs more than economy

- Ground Advantage: Core economy service, 2-5 days advertised, strong for <1 lb

- Parcel Select Ground: High-volume shippers, slower economy

Pricing structure:

Flat or simplified tiers for small items. Zone-based for packages over 1 lb.

You won’t get a custom USPS contract at low volume. But Commercial Pricing through ShipStation or Shopify gives discounted tiers that beat retail.

Delivery speed reality:

Advertised 2-5 days. Actual performance varies by lane.

Regional shipments hit the window. Long-haul or rural deliveries drift to 5-7+ days. Peak season or weather makes it worse.

No guaranteed delivery dates.

Tracking:

End-to-end visibility but fewer scan points than UPS or FedEx.

Packages show “in transit” for longer stretches. Less white-glove customer service than private carriers.

When USPS works:

- Lightweight products <1 lb (jewelry, cosmetics, accessories)

- Brands shipping under 2,000 orders monthly

- Non-time-sensitive shipments where cost > speed

The drawbacks:

- Inconsistent delivery on longer lanes damages customer experience

- Limited recourse for delayed or lost packages

- Single-carrier reliance = no backup during disruptions

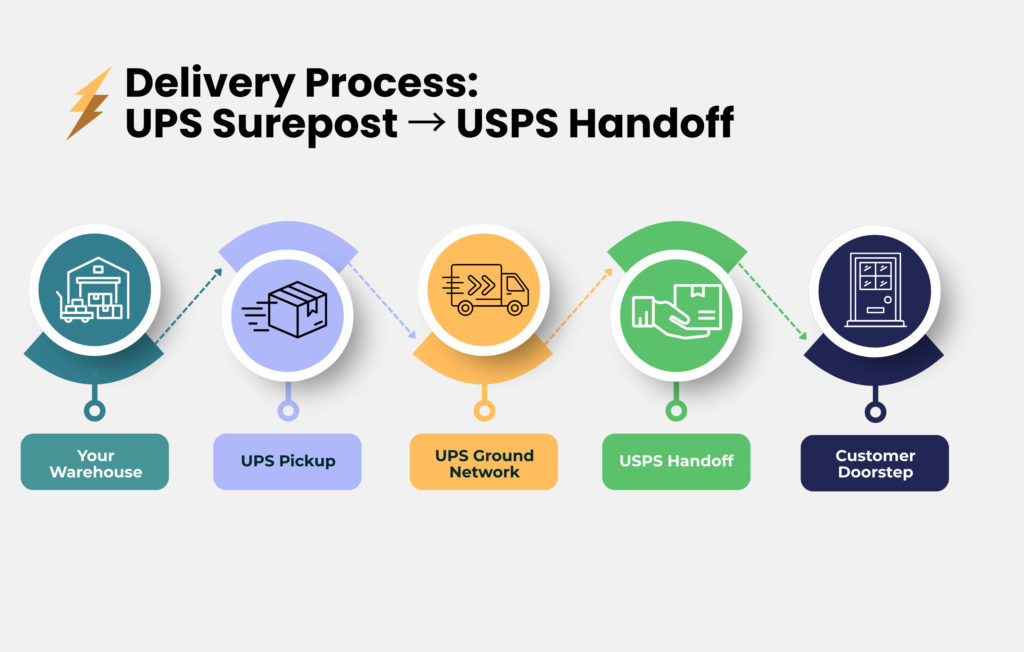

UPS SurePost: The Hybrid Option

UPS handles pickup and ground transport. USPS delivers the last mile.

You get UPS logistics plus USPS reach to every residential address, including PO boxes.

Who it’s for:

High-volume shippers wanting lower-priority residential shipping than UPS Ground. Better tracking than pure USPS.

You need a UPS account and negotiated rates. Makes sense around 2,000+ parcels monthly.

Pricing:

More economical than UPS Ground for residential shipments. Actual savings depend heavily on your contract.

Some brands see noticeable savings for lighter residential parcels. Others land close to Ground after surcharges.

Uses dimensional weight (divisor 139). Bulky, low-density packages get penalized.

Delivery speed:

Advertised 2-7 business days vs. 1-5 for UPS Ground.

Real world: 3-6 days in core zones. Longer for distant destinations. USPS final leg adds variability.

Tracking:

Follows through UPS, then continues with USPS scans.

During handoff, you might see “in transit” without fresh scans. Better than pure USPS, but the hybrid model creates gaps.

Sweet spot:

1-5 lb packages, non-time-sensitive, standard dimensions.

Limitations:

- Tracking gaps lead to customer inquiries

- Rural delivery times less predictable

- Need sufficient volume and good contract for economics to work

FedEx Ground Economy: The FedEx Alternative

FedEx’s economy residential solution. Replaced SmartPost.

FedEx handles pickup and linehaul. Most parcels deliver through FedEx’s own last-mile. USPS involvement greatly reduced vs. legacy SmartPost.

Requirements:

FedEx account with negotiated rates. Designed for high-volume ecommerce with non-urgent residential deliveries.

Pricing:

Similar band to UPS SurePost. Within a few percentage points either way depending on discounts and surcharges.

Dimensional weight uses similar divisor (139). Bulky items billed above actual weight.

Delivery speed:

Advertised 2-7 business days. Slower and cheaper than FedEx Ground.

Real world: 3-6 days in dense corridors. Longer on distant or low-density routes, especially peak season.

Tracking:

Continuous FedEx tracking end-to-end. No universal USPS handoff creating blind spots.

Still possible to see delayed scans or periods without updates.

When it works best:

Brands already using FedEx Ground. Low to mid-weight parcels where FedEx’s network shines.

Watch out for:

Strict dimensional weight enforcement. Pillows, blankets, oversized packaging = unexpected cost spikes.

Head-to-Head: Cost, Speed, Trade-offs

Pricing changes dramatically based on package weight, volume, dimensions.

Don’t treat any service as universally cheapest. Think in profiles and contracts.

Cost by Package Profile

Model your own packages. Negotiated discounts, surcharges, and DIM rules flip the winner.

Patterns that emerge:

<1 lb packages:

USPS Ground Advantage with Commercial Pricing usually wins for low and mid-volume shippers.

1-5 lb non-urgent residential:

UPS SurePost and FedEx Ground Economy can undercut USPS with negotiated contracts. Savings band is narrow. Varies by lane and agreement.

Bulky, lightweight items:

Dimensional weight trap hits hard for SurePost and Ground Economy.

Example: 3 lb package at 12×12×8 inches bills at ~10 lbs under 139 divisor. Much higher rate tier.

USPS dimensional rules less aggressive for smaller packages. Better for certain bulky lightweight SKUs.

Bottom line: USPS wins for very light and/or bulky parcels. UPS/FedEx economy becomes compelling for denser 1-5 lb shipments with discounts.

Delivery Speed Reality

All three position at roughly 2-7 business days. Real performance varies by lane.

In practice:

Zones 2-4 (regional):

Most shippers see 2-5 days across all three.

Zones 5-6 (cross-country):

Transit stretches to 4-7 days for economy hybrids.

Zones 7-8 and rural:

Deliveries push beyond stated averages. Shippers report 7-10 day outliers.

Hybrid or economy services sit 1-2 days slower than premium ground.

Peak season (Nov-Dec) degrades all three by multiple days. USPS and hybrids feel the strain first.

Tracking and Customer Experience

USPS:

Integrated tracking. Fewer in-route scans. Longer “in transit” stretches without location updates.

UPS SurePost:

Strong visibility in UPS system. USPS events for final mile. Handoff introduces short scan gaps when parcels move quickly between networks.

FedEx Ground Economy:

End-to-end FedEx tracking for most shipments. Marketed around continuous visibility, not USPS blind spots.

For lost or damaged packages:

USPS claims move slower. Less customer-centric feel.

UPS and FedEx provide more structured account support. But economy products don’t carry same guarantees as premium services.

Best Option by Brand Size

Small Brands: Under 2,000 Orders Monthly

Simplicity and baseline discounts matter more than optimized contracts.

USPS Ground Advantage for <1 lb: Hard to beat on price.

USPS Priority Mail for 1-3 lb: Best speed/cost trade-off when delivery time matters.

UPS SurePost and FedEx Ground Economy may not deliver enough savings to offset complexity.

USPS Commercial Pricing (Shopify, ShipStation, Stamps.com) unlocks discounted rates immediately. No direct contracts or high volumes needed.

Mid-Size Brands: 2,000-10,000 Orders Monthly

Time to negotiate with UPS and FedEx.

UPS SurePost and FedEx Ground Economy become attractive for 1-5 lb residential parcels. Meaningful per-package savings vs. USPS or premium ground. Optimize packaging to reduce DIM impact.

Don’t put all orders through one carrier.

Diversification reduces risk from regional disruptions, labor actions, weather, system outages.

Example: 2 lb package to mid-distance zone might price substantially lower on SurePost. Validate against your rate cards.

Evaluate GoBolt Parcel for:

- US-Canada cross-border

- Sustainability-driven customers

- Urban lanes where integrated network and EVs hit 3-day averages with substantial cost reductions

Large Brands: 10,000+ Orders Monthly

The game shifts to orchestration and leverage.

Use hybrid carrier strategy: UPS SurePost, FedEx Ground Economy, USPS, premium Ground. Route based on delivery zone, package weight, customer promise, margin.

Negotiated rates become highly competitive.

Sophisticated brands use rules engines and analytics to route each shipment to optimal service in real time.

Implement carrier diversification. Multiple carriers and services avoid single-point-of-failure risk.

Split volume strategically to keep negotiation leverage while earning aggressive incentives.

Use multi-carrier shipping software (ShipStation, ShipHero, Shippo) with dynamic rate shopping and automated carrier selection.

Deep Dive: For comprehensive analysis on ecommerce shipping methods, see our 2025 Guide to Ecommerce Shipping Methods

GoBolt Parcel: Diversification for Scaling DTC Brands

Alternative for DTC brands shipping 2,000+ orders monthly.

Addresses rising costs, inconsistent delivery times, tracking limitations with traditional economy services.

How it’s different:

Unlike legacy hybrids leaning on USPS, GoBolt operates vertically integrated logistics with its own last-mile capabilities. Strong focus on EV-powered delivery.

Supports mid-mile transportation and fulfillment orchestration. Reduces handoffs between carriers and warehouses.

Fewer handoffs = more predictable transit, improved visibility, lower risk during peak.

Performance:

Network focuses on high-density urban markets across US and Canada.

Case studies report ~3-day average transit and significant cost reductions (30-45% range, occasionally higher) vs. traditional carriers.

Real-time last mile tracking, AI-powered proof of delivery, carbon-neutral last-mile via EVs and verified offsets.

When it works:

Not a one-to-one replacement for USPS or economy carriers at very low volume.

Most effective as part of diversified carrier strategy for brands prioritizing:

- Delivery consistency

- Sustainability

- Reduced dependence on national carriers as they scale across North America

The Bottom Line: Match Strategy to Business Stage

Your brand size, order volume, package profile determine cost-effectiveness.

Under ~2,000 orders monthly:

USPS Ground Advantage and Priority Mail provide best mix of simplicity and cost for lightweight DTC parcels.

Between 2,000-10,000 orders:

Negotiate UPS SurePost and FedEx Ground Economy rates. Start layering in carrier diversification.

All three economy services trade speed and guarantees for lower cost. Sit slower than premium ground but often at lower effective rate.

The right choice depends on:

- Customer delivery-time expectations

- Product margins

- Sensitivity to tracking precision and sustainability

Brands scaling past 2,000 orders:

Treat carrier diversification as strategic hedge, not nice-to-have.

Evaluate alternatives like GoBolt Parcel for sustainability, US-Canada corridors, dense urban markets where integrated networks and EVs deliver speed and savings.

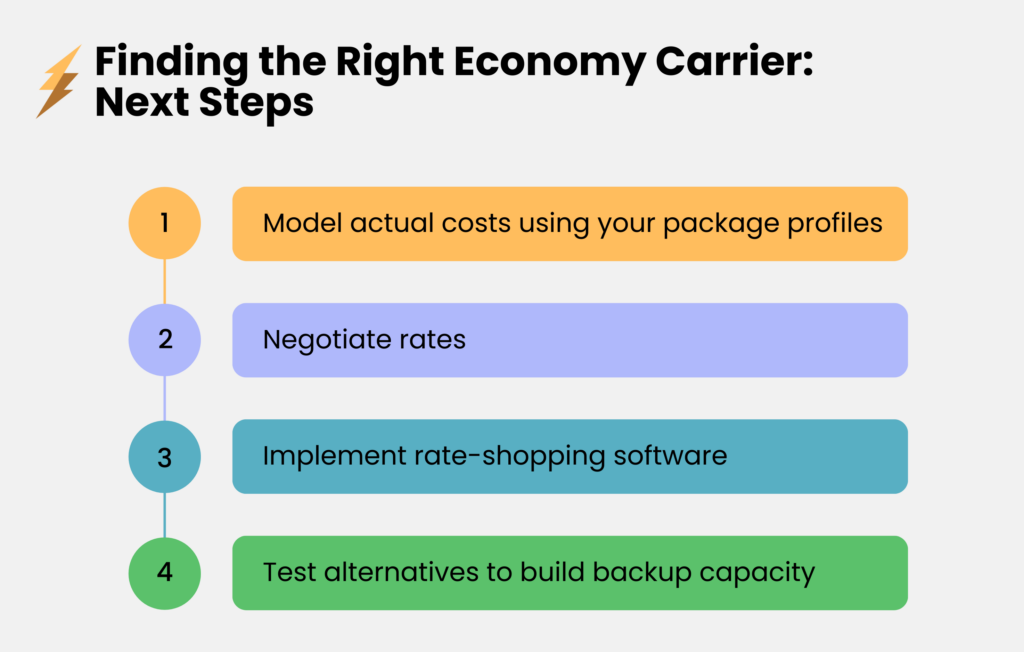

Action Steps

- Model actual costs using your package profiles

- Negotiate rates once you approach 1,000-2,000 monthly orders

- Implement rate-shopping software

- Test emerging alternatives on 10-20% of volume to build backup capacity before you need it

FAQs on Economy Shipping: USPS vs UPS SurePost vs FedEx Ground Economy

What's the main difference between UPS SurePost and FedEx Ground Economy?

Both are economy residential solutions for non-urgent ecommerce.

UPS SurePost combines UPS ground infrastructure with USPS final-mile delivery.

FedEx Ground Economy (formerly SmartPost) shifted toward FedEx-controlled linehaul and last-mile for most parcels.

Cost and speed fall in a tight band. Your existing carrier relationship, service mix, and negotiated discounts matter more than list rates.

When does USPS become more expensive than SurePost or Ground Economy?

The crossover happens with heavier parcels (1-5 lb+) at scale with strong UPS or FedEx contracts.

For brands shipping 2,000+ orders monthly, negotiated SurePost or Ground Economy can come in below USPS for certain weight/zone combinations. Highly specific to your discounts and surcharges.

For <1 lb packages or shippers without negotiated carrier rates, USPS Ground Advantage often wins.

Why do economy and hybrid packages have tracking gaps?

Hybrid models like UPS SurePost involve handoff to USPS for final delivery.

Scan events lag when parcels move between networks or sit awaiting delivery. Creates periods where status shows “in transit” without precise location.

USPS generates fewer intermediate scans than UPS or FedEx premium services. Can feel like a gap even when package moves normally.

FedEx Ground Economy marketed around continuous FedEx tracking. But like any ground service, can still experience delayed scans.

Can I use these services for international shipping?

No. These are primarily US domestic services.

For Canada shipments, consider USPS international options, UPS Worldwide, FedEx International, or alternatives like GoBolt Parcel for US-Canada cross-border ecommerce.

Each service requires both origin and destination in the United States. Separate products for international delivery.

How do I get volume discounts with UPS SurePost or FedEx Ground Economy?

Open commercial account with UPS or FedEx. Work with account rep or third-party consultant to negotiate rates based on current and projected monthly volume.

You typically need low-thousands of parcels monthly for meaningful discounts. Most aggressive pricing reserved for brands shipping many thousands monthly and consolidating portfolio with a carrier.

As volume grows, revisit contracts regularly. Use multi-carrier software to document performance and spend—that data is leverage in next negotiation.