- Written by:

- Amanda Conway

- Last Updated:

Here’s a paradox playing out across ecommerce right now: brands are scaling faster than ever, but shipping costs are consuming margin gains faster than revenue can grow. You’re not imagining it.

The numbers tell the story. Carrier rates jumped 5.9% in 2026 alone, and shipping costs overall have climbed nearly 40% over the past five years. Last-mile delivery now eats up 53% of your total shipping spend. Meanwhile, 40% of consumers will abandon your brand for a competitor if shipping takes longer than two days.

This isn’t just an operational headache anymore. Your choice of ecommerce shipping methods directly impacts unit economics, customer lifetime value, and even your ESG reporting. With carrier pricing volatility, disruption risks like strikes and capacity constraints, and customer expectations pulling in opposite directions – faster, greener, cheaper – the stakes have never been higher.

This guide breaks down the five main types of ecommerce shipping methods available in 2026, urrent cost benchmarks, practical tradeoff guidance, and a decision framework built for your specific business context.

Table of Contents

TL;DR: The 5 Ecommerce Shipping Methods

The strategic answer to rising shipping costs isn’t picking a single “best” carrier – it’s diversifying across regional carriers, parcel networks, and last-mile specialists while matching method to order value, delivery zone, and brand positioning. Brands processing 2,000+ monthly orders can achieve 25-35% cost reduction with 3-4 day average transit times using this approach.

The five main ecommerce shipping methods are:

- National carriers for broad coverage

- Regional carriers for zone-specific savings,

- Parcel networks for cost-optimized routing,

- Same-day specialists for urban delivery,

- Hybrid fulfillment + delivery providers.

Most scaling brands use 2-4 methods simultaneously, matching each to specific order values, delivery zones, and speed requirements.

What Are Ecommerce Shipping Methods?

Ecommerce shipping methods are the different carrier types, service levels, and delivery models brands use to transport products from warehouse to customer. Unlike choosing a single carrier, modern shipping strategy involves selecting the right method for each shipment based on destination, urgency, cost, and sustainability goals.

The method you choose affects three critical business metrics:

- Unit economics: Shipping can represent 5-15% of order value for mid-market DTC brands

- Customer satisfaction: 63% of consumers choose a different retailer for future purchases if shipping takes longer than two days

- Sustainability reporting: Last-mile delivery accounts for up to 50% of ecommerce CO2 emissions

The ecommerce shipping world has fundamentally changed since 2020. Single-carrier dependency proved risky during pandemic disruptions and the recent Canada Post strike. Today, 89% of retailers use alternative carriers, with 76% routing 16-50% of volume outside traditional national carrier networks.

The 5 Main Types of Ecommerce Shipping Methods

1. National Carriers

What they are: Large-scale shipping companies with nationwide or international coverage, including USPS, UPS, FedEx (United States), Canada Post, and Purolator (Canada).

How they work: National carriers operate extensive networks with service points across entire countries, offering multiple service tiers from ground economy to overnight express. They handle everything from first-mile pickup to last-mile delivery through their own infrastructure.

Cost structure: Premium pricing with surcharges for residential delivery, rural areas, oversized packages, and peak season volume. Average ecommerce order costs $7.96 to ship, but national carriers typically run above this benchmark. FedEx and UPS implemented 5.9% rate increases for 2026.

Delivery speed:

- Ground: 3-5 business days

- 2-Day: Standard for most consumer expectations

- Next-day: Available but expensive

- Same-day: Limited metro availability

Best for:

- Brands needing broad geographic coverage

- Orders to rural or remote areas outside regional carrier zones

- International shipments

- High-value orders where brand trust matters (customers recognize major carrier names)

Limitations: Highest cost per package, especially for residential delivery. Vulnerable to labor disputes and capacity constraints during peak season. Least flexible on sustainability options.

When to use national carriers: For orders shipping outside your regional carrier coverage areas, international destinations, or when customer expectations demand recognized brand names (luxury goods, high-ticket items).

Deep dive: See our detailed USPS vs UPS vs FedEx comparison to evaluate which national carrier fits your needs.

2. Regional Carriers

What they are: Mid-sized carriers operating in specific geographic zones where they’ve built delivery density, including OnTrac (Western US), Lone Star Overnight/LSO (Texas, Southwest), GoBolt (US and Canada), LaserShip (Eastern US).

How they work: Regional carriers focus on specific territories, building dense route networks that allow faster delivery and lower costs within their zones. They typically partner with national carriers for out-of-territory shipments, though many brands handle this routing themselves.

Cost structure: 20-40% lower than national carriers in their coverage zones. Fewer surcharges and more straightforward pricing. The savings come from route density—they’re not spreading infrastructure costs across an entire continent.

Delivery speed:

- Faster than national carriers in their territories (often next-day, where nationals offer 2-day)

- Ground service: 1-3 days within region

- Limited or no service outside their zones

Coverage zones by carrier:

- OnTrac: CA, AZ, NV, OR, WA, CO, UT (expanding)

- LSO: TX, OK, AR, LA, NM (expanding to Southeast)

- GoBolt: ON, QC, BC, AB in Canada and NY, GA, FL, TX, CA in the US

- LaserShip: East Coast, Mid-Atlantic, Southeast

Best for:

- Brands with concentrated customer bases in specific regions

- Orders shipping within regional carrier territories

- Cost optimization when 30%+ of volume ships to covered zones

- Brands needing faster delivery than nationals in those zones

Limitations: Geographic restrictions mean you’ll need multiple methods to cover all deliveries, or have a strong middle mile in place. Less brand recognition with consumers (though this rarely matters if delivery performance is solid).

Real-world impact: Footwear brands have achieved 60% shipping cost reduction while maintaining 3-day delivery by routing regional volume to specialized carriers. Apparel brands cut costs 40% while keeping next-day service in core markets.

3. Parcel Networks & Consolidation Services

What they are: Shipping methods that optimize routing through consolidation, zone-skipping, or multi-carrier selection — including USPS SurePost, FedEx Ground Economy, UPS Mail Innovations, and specialized networks like GoBolt Connect.

How they work: Parcel networks use hybrid models: consolidating packages at regional hubs, skipping intermediate zones to reduce distance-based costs, or selecting optimal carriers per shipment. Many inject packages into USPS for final delivery, combining long-haul efficiency with last-mile ubiquity.

Cost structure: Lower than direct national carrier shipping, typically optimized for lighter packages under 5 lbs. Cost savings of 15-60% compared to standard ground, with best economics on Zone 5+ shipments where zone-skipping provides maximum value.

Delivery speed:

- Ground service: 3-6 business days (slightly slower than direct national carriers)

- Transit time depends on consolidation point locations and final-mile handoff

- Less predictable than direct carrier service

Best for:

- Lightweight packages (under 5 lbs) with lower time sensitivity

- Orders with 4-6 day acceptable delivery windows

- Long-distance shipments where zone-skipping reduces costs significantly

- Brands prioritizing cost over speed for standard-value orders

Limitations: Slower and less predictable than direct carrier delivery. Handoffs between networks create tracking gaps and exception points. Not ideal for time-sensitive or high-value orders where delivery certainty matters.

Popular parcel network options:

- USPS SurePost/UPS Mail Innovations: UPS long-haul + USPS last-mile

- FedEx Ground Economy: FedEx long-haul + last-mile

- GoBolt Connect: Multi-carrier routing with zone optimization

Deep dive: Compare economy shipping options like USPS, UPS SurePost vs FedEx Ground to see which service fits your order profiles.

4. Same-Day Delivery Specialists

What they are: On-demand delivery platforms focused exclusively on rapid final-leg delivery in dense urban markets, including DoorDash Drive, Uber Direct, Gopuff, and Instacart.

How they work: Same-day specialists operate hub-and-spoke models in metros, receiving consolidated packages at urban micro-fulfillment centers and deploying gig-economy couriers for final delivery within hours. Unlike traditional carriers, these platforms leverage flexible courier networks that scale up or down based on demand.

Cost structure: Variable. Same-day typically costs $5-15 per delivery as a loss-leader for customer acquisition, while scheduled same-day delivery can be more expensive than traditional carriers but justifies the premium through speed. Economics depend heavily on delivery density and distance from fulfillment hubs.

Delivery speed:

- Same-day: 2-6 hours from order

- Scheduled same-day: Delivery windows later that day

- On-demand: 30-90 minutes (premium pricing)

- Express: 1-2 hours in select markets

Best for:

- Urban deliveries within platform coverage zones (typically 15-25 mile radius from hubs)

- Time-sensitive orders where same-day delivery drives conversion

- Perishable goods, meal kits, pharmacy items, grocery

- High-margin products where delivery cost can be absorbed or passed to customer

- Brands competing on speed as a key differentiator

Limitations: Geographic restrictions to major metros and dense urban areas. Significantly higher cost per delivery than multi-day options. Requires inventory positioned very close to customers, often through distributed fulfillment or dark stores. Limited integration with traditional shipping workflows—often requires separate systems.

The market reality: Same-day delivery is now a $9.25 billion US market growing at 6% annually. These platforms excel when speed is the primary purchase driver and customer willingness to pay (or brand willingness to subsidize) justifies premium costs.

5. Hybrid Fulfillment + Delivery Providers

What they are: 3PLs offering both warehousing/fulfillment and integrated delivery under one roof, combining inventory management, order processing, and last-mile logistics in a single service.

How they work: You send inventory to the provider’s fulfillment centers. They pick, pack, and ship orders using their own delivery fleet or carrier network. The integration eliminates handoffs between separate fulfillment and shipping providers.

Cost structure: Bundled pricing that includes storage, fulfillment labor, and delivery. Often more cost-effective than managing separate fulfillment and shipping vendors, especially for brands doing 2,000+ monthly orders.

Delivery speed:

- Depends on fulfillment center proximity to customers

- Often faster than traditional fulfillment + national carrier because inventory sits closer to delivery zones

- Some hybrid providers offer same-day or next-day in core markets

Best for:

- Brands outsourcing fulfillment operations entirely

- Companies wanting simplified vendor management (one partner vs separate fulfillment + carriers)

- Businesses targeting specific regions where hybrid providers have strong networks (e.g., Canadian brands using Canadian hybrid providers)

- Brands needing 2-day delivery without distributed fulfillment complexity

Limitations: Less control over fulfillment operations compared to owned warehouses. Geographic coverage limited by provider’s fulfillment network. Switching providers is complex once inventory is committed.

Canadian context: Hybrid providers like GoBolt offer advantages for Canadian brands — avoiding harsh cross-border shipping costs, serving Canadian customers faster, and supporting “Win Canada” strategies through domestic fulfillment and delivery.

Understanding Multi-Category Providers

Some logistics providers operate across multiple shipping method categories with different service offerings. GoBolt, for example, functions as:

- A regional carrier with direct delivery fleet coverage in Canada (ON, QC, BC, AB) and the US (NY, GA, FL, TX, CA)

- A parcel network through GoBolt Connect, which optimizes routing across multiple carriers

- A hybrid provider offering integrated fulfillment and delivery services

This multi-category approach can simplify your shipping strategy. Instead of managing separate vendors for regional delivery, parcel optimization, and fulfillment, one provider handles multiple methods. When evaluating carriers, ask which categories they serve and whether consolidating with a multi-service provider makes sense for your operation.

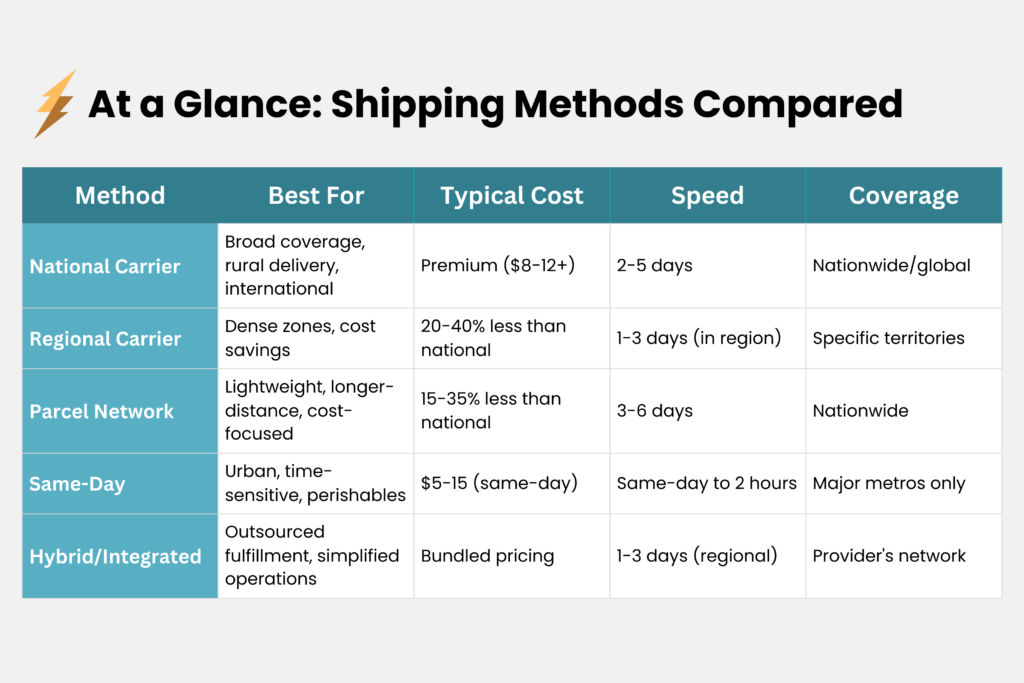

Shipping Method Comparison: At a Glance

Method Type | Best For | Typical Cost | Speed | Coverage |

National Carriers | Broad coverage, rural delivery, international | Premium ($8-12+) | 2-5 days | Nationwide/global |

Regional Carriers | Dense zones, cost savings | 20-40% less than national | 1-3 days (in region) | Specific territories |

Parcel Networks | Lightweight, longer-distance, cost-focused | 15-35% less than national | 3-6 days | Nationwide |

Same-day Specialists | Urban, time-sensitive, perishables | $5-15 (same-day) | Same-day to 2 hours | Major metros only |

Hybrid Providers | Outsourced fulfillment, simplified operations | Bundled pricing | 1-3 days (regional) | Provider’s network |

How to Choose the Right Shipping Method for Your Business

Step 1: Analyze Your Order Data

Pull 3-6 months of shipping data and segment by:

- Destination zones: What percentage ships to Zone 1-3 (local), Zone 4-6 (regional), Zone 7-8 (distant)?

- Order values: How many orders fall into $0-50, $50-150, $150+ brackets?

- Package weights: Are most orders under 5 lbs, 5-15 lbs, or oversized?

- Customer locations: Do you have density in specific regions or metros?

This analysis reveals which methods could serve the majority of your volume.

Step 2: Match Method to Order Profile

High-value orders ($150+):

- Use national carriers for brand trust and reliability

- Consider regional carriers with strong reputations in their zones

- Avoid economy parcel networks where tracking gaps create risk

Standard orders ($50-150):

- Regional carriers in covered zones for cost and speed balance

- Parcel networks for longer-distance shipments

- Mix of methods based on destination

Low-value orders (<$50):

- Parcel networks to protect margins

- Regional carriers where available

- Last-mile specialists for urban density

Geographic segmentation:

- Urban orders: Last-mile specialists or regional carriers

- Suburban/rural: National carriers or parcel networks

- Concentrated regions: Regional carriers

- Dispersed national: National carriers or parcel networks

Step 3: Factor in Business Variables

Order volume matters:

- <500 orders/month: Start with 1-2 national carriers

- 500-2,000 orders/month: Add 1-2 regional carriers or parcel networks

- 2,000+ orders/month: Multi-method approach with 3-4 carriers offers 25-35% cost reduction

Delivery speed expectations:

- Premium brands: 2-day or next-day standard (national or regional carriers)

- Value brands: 3-5 day acceptable (parcel networks, regional ground)

- Urgency products: Same-day/next-day capability (last-mile specialists)

Sustainability positioning:

- Brands with ESG commitments: Last-mile specialists with EV fleets

- Customer demand: 87% of shoppers are willing to change habits to reduce environmental impact

- Reporting needs: Carriers with Scope 3 emissions tracking

Step 4: Consider Risk & Flexibility

Diversification protects against:

- Carrier strikes or labor disputes (Canada Post 2024, UPS contract negotiations)

- Peak season capacity constraints (carriers cap volume during holidays)

- Service failures or delivery issues with single providers

Strategic method mix templates:

Starter (launching/scaling):

- 1 national carrier (broad coverage)

- 1 regional carrier (cost savings in key zones)

Growth (2,000+ monthly orders):

- 1-2 national carriers (coverage + backup)

- 2 regional carriers (cost optimization)

- 1 parcel network (economy option)

Enterprise (10,000+ monthly orders):

- Full multi-method approach

- Automated routing software

- Last-mile specialists for urban density

- Hybrid fulfillment for distributed inventory

Step 5: Test Before Committing

Don’t overhaul your entire shipping strategy at once:

- Pilot with 5-10% of volume on new methods

- Measure performance against existing carriers (cost per package, transit times, delivery success rate, customer satisfaction)

- Scale gradually to 25%, then 50% of eligible volume

Monitor continuously and adjust quarterly

Deep dive: Get the Carrier Diversification ebook and learn how to build a complete carrier diversification strategy for operational implementation details.

The Technology Layer: Routing & Tracking

Shipping methods only work efficiently with technology to automate carrier selection and track deliveries. Here’s what matters:

Automated routing software:

- Selects optimal method per shipment based on destination zone, order value, delivery speed requirements, and sustainability preferences

- Eliminates manual carrier decisions that create inconsistent costs and customer experiences

- Integrates with Shopify, WooCommerce, BigCommerce platforms

Modern tracking capabilities:

- GPS-powered real-time tracking (package location like Uber)

- AI-powered proof of delivery with photo verification

Order management issues are resolved before customers notice issues

Business impact: 62% of consumers care more about accurate delivery estimates than speed itself. Modern tracking reduces “Where Is My Order?” inquiries to near-zero while improving customer satisfaction.

Cost Implications: What to Expect

Understanding cost structures helps set realistic expectations for each method:

National carriers:

- Ground: $8-12 per package

- 2-Day: $12-18 per package

- Next-day: $18-30+ per package

- Surcharges: Residential (+$4-5), rural (+$3-8), oversized (+$15-50)

Regional carriers:

- 20-40% less than national carriers in coverage zones

- Fewer surcharges, more transparent pricing

- Ground: $5-8 per package (in territory)

Parcel networks:

- 15-35% less than national carrier ground

- Best economics on lightweight packages (<5 lbs)

- Ground: $5-9 per package (Zone 5+)

Same-day specialists:

- Same-day: $5-15 per delivery (often loss-leader pricing or premium)

- Express (1-2 hours): $10-25+ per delivery

- On-demand: Variable pricing based on distance and demand

- Cost increases significantly outside dense urban cores

The average: Ecommerce orders cost $7.96 to ship on average, but strategic method selection can reduce this by 20-40%.

Deep dive: Get detailed ecommerce shipping cost benchmarks and optimization strategies in our comprehensive cost guide.

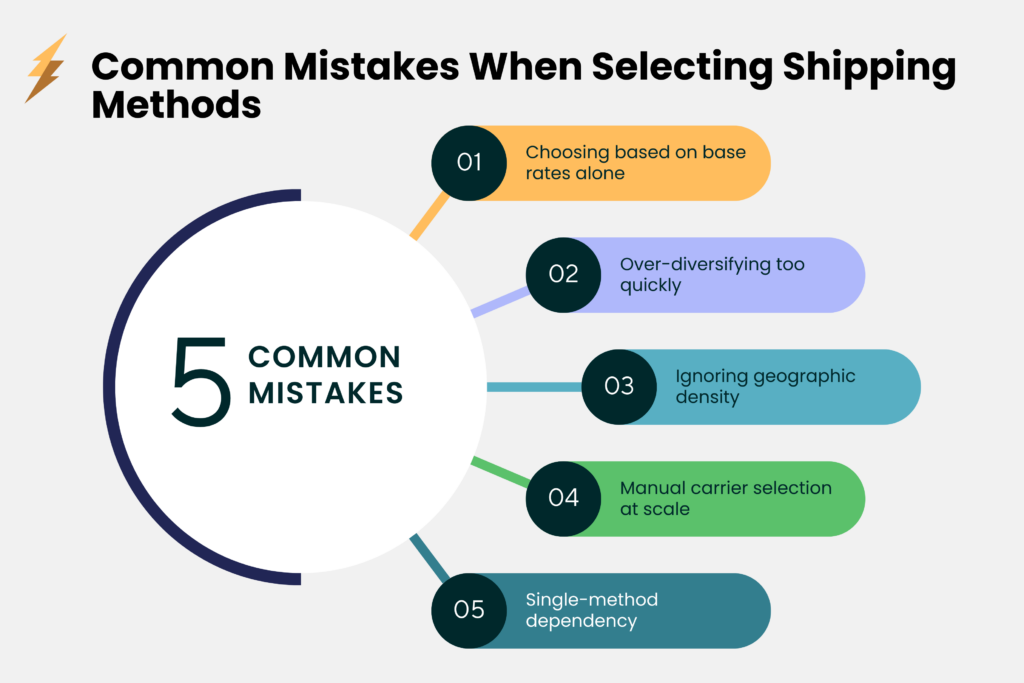

Common Mistakes When Selecting Shipping Methods

Mistake #1: Choosing based on base rates alone

Failed deliveries hit 8-20% of shipments at some carriers. Residential surcharges, rural fees, and oversized charges quickly erase savings from cheaper base rates. Evaluate total delivered cost, not just the advertised rate.

Mistake #2: Over-diversifying too quickly

Retailers that added too many carriers during pandemic disruptions now face operational chaos—limited warehouse sortation capability, maxed-out carrier pickup capacity, and inconsistent customer experiences. Start with 2-3 strategic methods and scale gradually.

Mistake #3: Ignoring geographic density

Regional carriers only save money if you ship meaningful volume to their territories. Don’t add a regional carrier for 5% of orders—the operational complexity isn’t worth it. Look for 20%+ volume concentration in covered zones.

Mistake #4: Manual carrier selection at scale

Without automated routing rules, teams make inconsistent decisions that miss savings opportunities. Shipping software becomes essential once you’re processing 500+ orders monthly.

Mistake #5: Single-method dependency

When Canada Post struck in 2024, single-carrier Canadian brands scrambled while diversified brands rerouted seamlessly. Backup capacity isn’t optional anymore—it’s operational risk management.

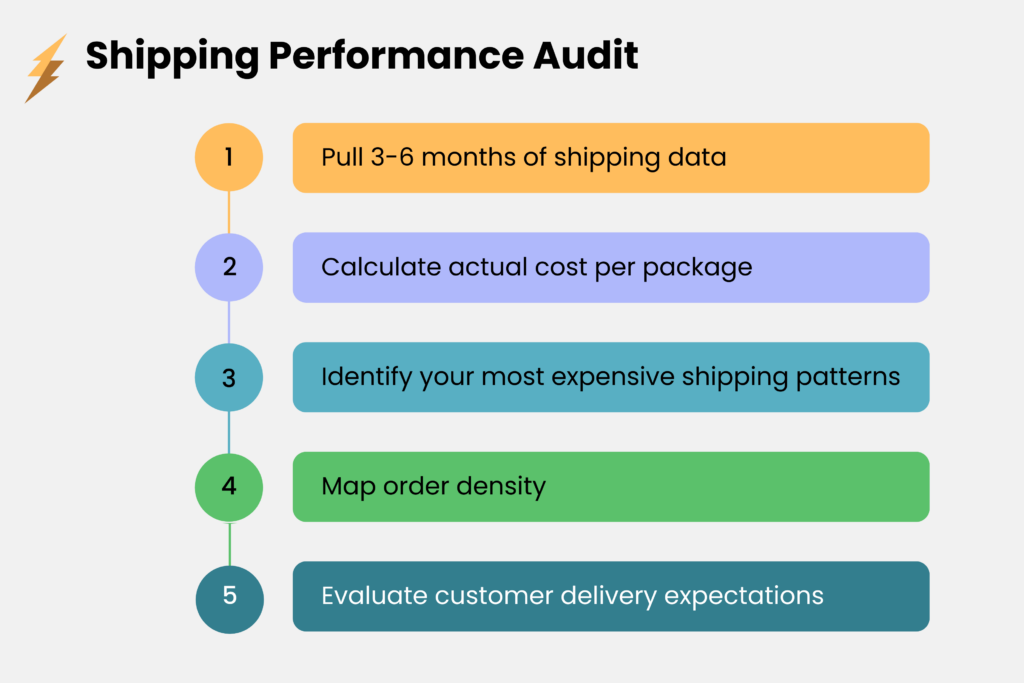

Your Next Step: Audit Current Shipping Performance

Before changing methods, understand what you’re currently paying and where improvements exist:

- Pull 3-6 months of shipping data by carrier, zone, package weight, and delivery speed

- Calculate actual cost per package including surcharges (not just base rates)

- Identify your most expensive shipping patterns (zones, package types, destinations)

- Map order density to potential regional carrier coverage

- Evaluate customer delivery expectations by order value and segment

This audit reveals which methods could serve your volume most cost-effectively.

Deep dive: See our Ecommerce Shipping Guide to evaluate methods across cost, speed, sustainability, and reliability.

Ecommerce Shipping Methods FAQs

What is the best ecommerce shipping method?

There’s no single “best” ecommerce shipping method—the optimal choice depends on your order value, destination zone, delivery speed requirements, and business priorities. Most scaling brands use 2-4 methods simultaneously: national carriers for broad coverage and rural delivery, regional carriers for cost savings in dense zones, parcel networks for economy long-distance shipping, and last-mile specialists for urban same-day or next-day delivery. The strategic approach matches method to order profile rather than forcing all shipments through one carrier.

What's the difference between national carriers and regional carriers?

National carriers (UPS, FedEx, USPS, Canada Post) offer broad geographic coverage across entire countries but charge premium rates. Regional carriers (OnTrac, LSO, GoBolt) operate in specific territories where they’ve built delivery density, typically saving brands 20-40% in their coverage zones while delivering faster than nationals in those regions. Regional carriers excel for orders shipping within their territories, while national carriers handle shipments outside regional coverage or to rural areas. Most brands use both: regional carriers for cost optimization in key zones, national carriers for broad coverage.

How do parcel networks differ from regular shipping?

Parcel networks like USPS SurePost, FedEx SmartPost, and specialized services like GoBolt Connect optimize routing through consolidation and zone-skipping rather than direct carrier shipments. They typically consolidate packages at regional hubs, skip intermediate zones to reduce distance costs, or select optimal carriers per shipment. Many inject packages into USPS for final delivery. Parcel networks cost 15-35% less than direct carrier shipping but take 3-6 days versus 2-5 days for national carriers. They work best for lightweight packages under 5 lbs with 4-6 day acceptable delivery windows where cost matters more than speed.

What are last-mile specialists and when should I use them?

Last-mile specialists focus exclusively on final-leg delivery in dense urban markets using hub-and-spoke models and often electric vehicle fleets. Carriers like Amazon Logistics, DoorDash Drive, Uber Direct, and GoBolt’s EV network excel at same-day or next-day urban delivery. Use last-mile specialists for time-sensitive orders in metro areas (same-day delivery drives conversion), perishable goods requiring quick delivery, and when sustainability matters to your brand positioning—many run EV fleets that cut CO2 emissions while reducing fuel costs. They’re geographically limited to major metros and require inventory positioned close to customers.

Should I use multiple shipping methods?

Yes — 89% of retailers now use multiple shipping methods, with 76% routing 16-50% of volume outside traditional national carriers. Multi-method shipping protects against disruptions (carrier strikes, peak season capacity constraints), optimizes costs by matching method to order profile, and improves delivery performance through strategic carrier selection. Start with 2-3 methods: one national carrier for broad coverage plus 1-2 regional carriers or parcel networks for cost optimization. Brands processing 2,000+ monthly orders can achieve 25-35% cost reduction with 3-4 day average transit times using multi-method approaches. Scale gradually—test new methods with 5-10% of volume before committing.

How do I choose between speed and cost when selecting a shipping method?

Segment orders by value and customer expectations rather than choosing universally fast or universally cheap. High-value orders ($150+) warrant faster, premium shipping methods (national or regional carriers) for reliability and customer confidence. Standard orders ($50-150) benefit from cost-optimized 2-3 day delivery that protects margins—regional carriers or parcel networks work well. Low-value orders (<$50) should use economy methods like parcel networks to maintain profitability. Remember: 62% of consumers prioritize accurate delivery dates over pure speed, and 71% are willing to pay an extra $3 for next-day delivery when they need it—so reliability matters more than always choosing the fastest option. Match method to order value, communicate timelines clearly, and customers rarely abandon over an extra day.

Are sustainable shipping methods more expensive?

Short answer: no, sustainable shipping is not more expensive. While EV delivery fleets require higher upfront investment, charging costs up to 70% less than refueling gas vehicles and electric fleets have lower maintenance costs that offset initial expenses. Plus, 87% of consumers are willing to change their shopping habits to reduce environmental impact, and 82% are willing to wait longer for eco-friendly shipping—sustainable delivery drives conversions and loyalty. Efficiency gains, government incentives for EV fleets, and immunity from volatile fuel prices create real savings over time. Practically, partnering with carriers offering EV delivery options (many last-mile specialists run electric fleets) adds sustainability without premium pricing, while optimizing routes to reduce total miles driven cuts both costs and emissions simultaneously.