Ecommerce shipping has never been more expensive — and most brands still don’t know exactly why.

Carrier rate increases are easy to blame. FedEx and UPS surcharges are visible, painful, and show up neatly on invoices. But in 2026, the real cost of shipping an ecommerce order goes far beyond the label price. It’s the cumulative effect of inventory placement, fulfillment speed, returns, last-mile performance, and disconnected systems quietly eroding margin with every order shipped.

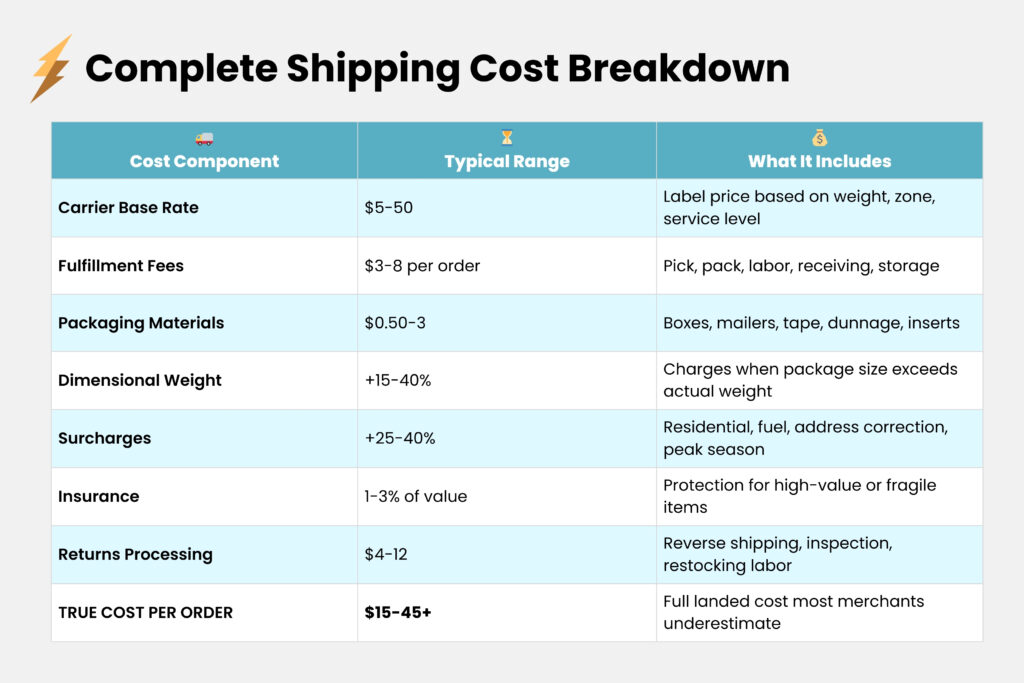

In 2026, the average ecommerce brand pays $8–$15 per order to ship — but 30–40% of that cost is hidden in surcharges, fulfillment delays, and returns that never show up on a carrier invoice.

That gap between what brands think they’re paying and what shipping actually costs is widening.

Recent logistics research shows that cost remains the number-one factor when brands evaluate fulfillment partners — yet delivery speed and reliability are the top reasons they switch.

According to GoBolt’s 2025 State of Logistics Report, cost remains the top reason brands switch 3PLs, while delivery speed and reliability are the leading reasons they choose a new provider — reinforcing that cost and speed are no longer competing priorities.

The brands controlling shipping costs in 2026 aren’t just negotiating harder on rates. They’re redesigning their shipping methods and how orders move — from warehouse to doorstep — and eliminating inefficiencies that compound long before a carrier ever scans a package.

This is what the real cost of shipping looks like now — and where ecommerce brands are leaking margin without realizing it.

TL;DR: The Real Cost of Ecommerce Shipping in 2026

Shipping costs in 2026 aren’t driven by carrier rates alone.

Most ecommerce brands overpay because costs compound across inventory placement, fulfillment speed, returns, surcharges, and disconnected systems — long before a shipping label is created.

Brands that reduce shipping costs sustainably focus on:

- Lowering shipping distance through smarter network design

- Improving fulfillment speed to avoid expensive delivery upgrades

- Understanding that total shipping cost ($8-15/order) is 25-40% higher than carrier rates alone

- Using shipping orchestration to route orders based on total cost, not static rules

Carrier diversification can help — but only as part of a broader system designed to control total shipping cost, not just label prices.

AI Summary

In 2026, ecommerce shipping costs extend far beyond carrier rates and are driven by compounding factors such as inventory placement, fulfillment speed, returns management, surcharges, and fragmented logistics systems. Brands that reduce shipping cost per order focus on lowering delivery distance, improving warehouse turnaround times, gaining visibility into total shipping cost, and using shipping orchestration to route orders based on cost and performance rather than static carrier rules. Carrier diversification can support these efforts, but the largest savings come from controlling the entire order journey, not just negotiating cheaper labels.

Ecommerce Shipping Costs in 2026: Carrier Rate Benchmarks

Most brands evaluate shipping costs by looking at carrier rates. Here’s what those baseline prices look like in 2026 — before surcharges, fulfillment inefficiencies, and returns are factored in.

Understanding cost structures helps set realistic expectations for each method:

National carriers:

- Ground: $8-12 per package

- 2-Day: $12-18 per package

- Next-day: $18-30+ per package

- Surcharges: Residential (+$4-5), rural (+$3-8), oversized (+$15-50)

Regional carriers:

- 20-40% less than national carriers in coverage zones

- Fewer surcharges, more transparent pricing

- Ground: $5-8 per package (in territory)

Parcel networks:

- 15-35% less than national carrier ground

- Best economics on lightweight packages (<5 lbs)

- Ground: $5-9 per package (Zone 5+)

Same-day specialists:

- Same-day: $5-15 per delivery (often loss-leader pricing or premium)

- Express (1-2 hours): $10-25+ per delivery

- On-demand: Variable pricing based on distance and demand

- Cost increases significantly outside dense urban cores

The carrier rate average: $7.96 per label. But when surcharges, fulfillment delays, and returns are included, total cost per order rises to $8–15 — 25–40% higher than the base rate most brands budget for.

Deep Dive: For comprehensive analysis on economy shipping options, see our 2026 Economy Shipping Comparison Guide

Why Ecommerce Shipping Costs Keep Rising (Even When Rates Look Competitive)

Most ecommerce teams evaluate shipping costs through a single lens: carrier pricing.

That’s understandable. Carrier invoices are tangible, frequent, and hard to ignore. But focusing only on rates misses the bigger picture. In practice, shipping costs rise because inefficiencies stack on top of one another across the entire order lifecycle.

Here’s where costs quietly compound.

Distance, zones, and inventory placement

Every additional zone an order travels increases cost — not just in base rates, but in fuel surcharges, delivery risk, and transit time. Yet many brands still ship the majority of orders from a single fulfillment location, turning avoidable Zone 6–8 shipments into a daily margin tax.

Brands shipping 5,000 orders per month to overpay by $2–$5 per package.

Fulfillment speed vs. shipping cost tradeoffs

Slow fulfillment doesn’t just hurt CX — it forces expensive shipping decisions. When warehouse turnaround lags, brands compensate by upgrading service levels to meet delivery promises. Faster fulfillment is often the cheapest way to lower shipping costs, but it’s rarely treated that way.

Returns and reverse logistics costs

Returns are no longer a secondary concern. Over half of brands cite returns management as a critical logistics capability, and more than a third want their 3PLs to invest more heavily in returns processing — underscoring how reverse logistics directly impacts total shipping cost and margin.

Surcharges and accessorial fees

Residential delivery fees, fuel surcharges, dimensional weight pricing, peak season premiums — these add-ons routinely inflate shipping spend by 25–40% beyond quoted rates. Brands that evaluate only base rates consistently underestimate their true cost per shipment.

Put together, it’s common for brands shipping 5,000 orders per month to overpay by $2–$5 per package without any single failure point to blame. That’s $120,000–$300,000 per year leaking out through small, compounding inefficiencies.

The problem isn’t one bad decision. It’s a system that isn’t designed to see — or control — total shipping cost.

The Visibility Gap That Makes Ecommerce Shipping Costs Hard to Control

If shipping costs feel impossible to pin down, it’s usually because they are.

The visibility gap is well documented: 77% of brands say last-mile performance and cost tracking are critical to fulfillment operations, yet many still lack real-time insight into how shipping decisions affect total cost per order.

More than half also identify real-time inventory tracking as essential — highlighting how deeply shipping cost is tied to upstream fulfillment decisions

Why shipping data lives in silos

As ecommerce operations scale, visibility breaks down. Data lives across too many systems — WMS platforms, carrier portals, 3PL dashboards, returns tools — none of them designed to show true cost per order in one place.

How fragmented systems inflate cost per order

Without unified visibility, teams end up optimizing in silos:

- Fulfillment teams chase speed

- Finance teams chase lower rates

- CX teams chase fewer delivery complaints

Each decision makes sense locally. Globally, costs rise.

Why Optimization Without Visibility Fails

This is why so many brands feel like they’re “doing everything right” and still see shipping eat a larger share of revenue every year. You can’t control what you can’t see — and most shipping stacks were never built to connect fulfillment, last mile, and returns into a single cost picture.

Why optimization without visibility fails

In 2026, the brands winning on shipping aren’t adding more tools. They’re consolidating decision-making — using real-time cost and performance data to route orders intelligently across fulfillment locations, delivery networks, and service levels.

Carrier choice matters. But it only becomes powerful when it’s part of a broader system designed around orchestration, not isolated optimization.

What Actually Lowers the Total Cost of Ecommerce Shipping

Reducing shipping costs isn’t about chasing the cheapest label. It’s about eliminating waste across the entire delivery journey.

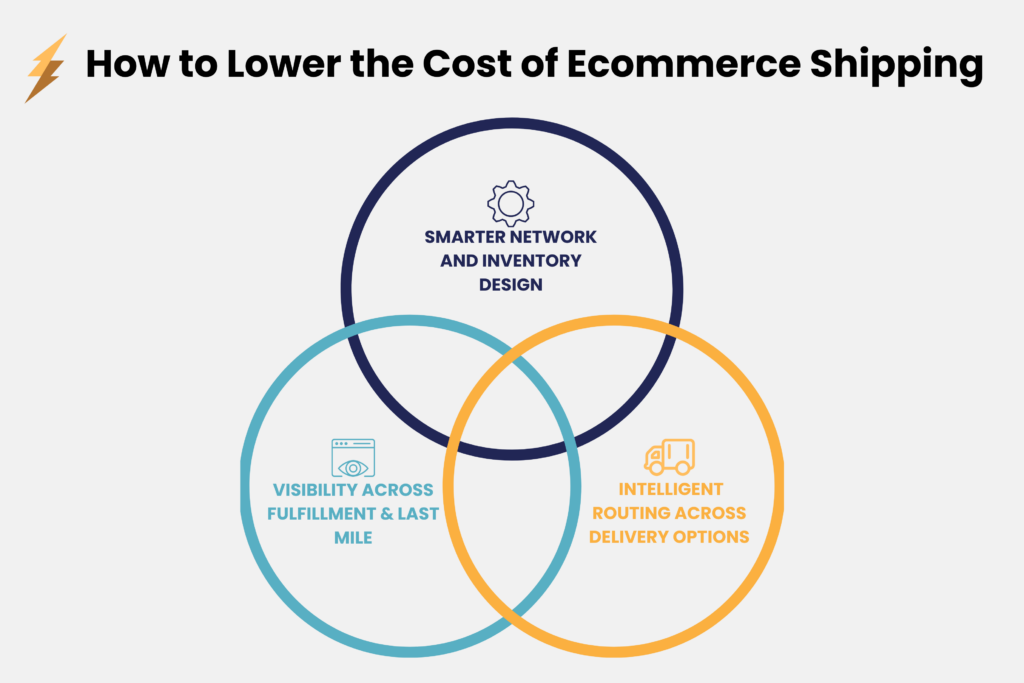

The most effective strategies focus on three areas.

1. Smarter network and inventory design

Reducing distance is still the most reliable way to cut cost. That means better inventory placement, faster fulfillment turnaround, and routing logic that minimizes unnecessary zones — not just rate shopping at checkout.

2. Intelligent routing across delivery options

Different orders have different cost profiles. Weight, dimensions, destination, promised delivery speed — all of these variables matter. Brands that route orders dynamically based on cost and performance consistently outperform those using static rules or single-carrier defaults.

This is where tactics like regional carriers, zone-skipping, or direct injection can help — but only when they’re applied selectively and supported by the right infrastructure.

3. Unified visibility across fulfillment & last mile

When fulfillment, last mile, and returns operate from the same data layer, cost control becomes proactive instead of reactive. Teams can see where margins erode, test changes quickly, and adjust before small inefficiencies turn into annual losses.

This shift — from rate optimization to orchestration — is where meaningful savings actually come from.

Why Shipping Orchestration Matters More Than Optimization in 2026

The Limits of Rate Shopping

Most shipping stacks were built to execute, not to decide.

They generate labels, pass tracking updates, and reconcile invoices — but they don’t answer the question that matters most in 2026:

“Is this the lowest total-cost way to deliver this order?”

From Execution Tools to Decision Systems

Modern shipping orchestration layers fill that gap by:

- Centralizing cost and performance data across fulfillment and last mile

- Applying routing logic based on real-world constraints, not static preferences

- Making tradeoffs between speed, cost, and reliability explicit — and measurable

When brands adopt orchestration, carrier diversification becomes a capability, not a strategy. It’s one lever among many — used where it makes economic sense, not applied universally.

A Smarter Way to Control Ecommerce Shipping Costs

Orchestration Without Operational Complexity

Some logistics platforms are being built specifically around this orchestration model.

Rather than acting as another carrier or point solution, platforms like GoBolt Connect focus on reducing total shipping cost by simplifying how orders move across fulfillment, delivery networks, and sustainability-focused infrastructure — all through a single system.

For brands, the benefit isn’t just access to more delivery options. It’s the ability to control cost, speed, and visibility together, without adding operational complexity.

That distinction matters in 2026.

The Bottom Line

The cheapest shipping label rarely equals the lowest total cost.

In 2026, ecommerce shipping costs are shaped long before a package hits a carrier network — and long after it leaves one. Brands that understand this stop chasing marginal rate improvements and start fixing the systems that quietly drain margin every day.

If shipping still feels like a black box, that’s the real cost.

And it’s one you can no longer afford to ignore.

Ecommerce Shipping Costs: FAQs

What is the average cost to ship an ecommerce order in 2026?

The average cost to ship an ecommerce order in 2026 is $8–$15 per order. This includes base carrier rates plus surcharges, fulfillment inefficiencies, and returns. For many brands, total shipping cost is 25–40% higher than the advertised label price.

Why are ecommerce shipping costs increasing every year?

Ecommerce shipping costs increase due to:

- Longer average shipping distances

- Higher customer expectations for fast delivery

- Rising fuel, residential, and peak surcharges

- Increased return rates

- Fragmented logistics systems that hide true cost

These factors compound even when base rates appear stable.

Is carrier diversification the best way to reduce ecommerce shipping costs?

Carrier diversification can reduce shipping costs, but it is not a standalone solution. The largest savings come from improving fulfillment speed, reducing shipping distance, and routing orders based on total cost. Diversification works best as part of a broader shipping orchestration strategy.

What is shipping orchestration in ecommerce?

Shipping orchestration is the process of dynamically routing orders based on total cost, delivery speed, and performance data across fulfillment locations and delivery networks. Unlike basic rate shopping, orchestration evaluates the full cost of delivering each order, not just the cheapest label.

How can ecommerce brands reduce shipping costs without slowing delivery?

Brands reduce shipping costs without slowing delivery by:

- Placing inventory closer to customers

- Improving warehouse fulfillment speed

- Using dynamic routing instead of static carrier rules

- Aligning delivery speed promises with real fulfillment capabilities

Faster fulfillment often lowers shipping cost.

What’s the difference between shipping rates and total shipping cost?

Shipping rates reflect the price of a carrier label. Total shipping cost includes fulfillment delays, surcharges, returns processing, customer service impact, and failed deliveries. Brands that focus only on rates often underestimate shipping costs by 25–40%.

Do sustainable shipping options increase ecommerce shipping costs?

Sustainable shipping options do not always increase costs. In dense regions, electric-vehicle delivery and route optimization can match or beat traditional delivery pricing while reducing fuel usage. Sustainability and cost efficiency increasingly overlap in modern logistics networks.

What is the biggest mistake brands make when trying to lower shipping costs?

The biggest mistake is optimizing shipping rates instead of total cost. Brands often focus on negotiating carriers while ignoring fulfillment speed, inventory placement, and visibility gaps — which usually drive higher costs than carrier pricing alone.