- Last updated on

- January 5, 2026

- Written by:

- Amanda Conway

You’ve stared at enough carrier rate cards to know they aren’t designed for clarity. That residential surcharge buried on page 47? The dimensional weight threshold that changed without warning? The “additional handling” fee that somehow applies to half your shipments? They’re all there by design.

Most shippers stop at choosing a carrier. But if you’re moving thousands of parcels a month, you’re leaving money on the table. The difference between accepting a rate card at face value and understanding what you’re actually paying can swing your logistics budget by 20-40%.

This guide breaks down what you need to know about carrier rate cards in 2026, from decoding accessorial charges to negotiating carrier rates that match your package profile. We’ll cover the cost traps that erode margins, dimensional rules that determine conveyability, and the regional carrier gotchas that blindside even experienced teams. Think of this as moving beyond carrier selection into real cost optimization.

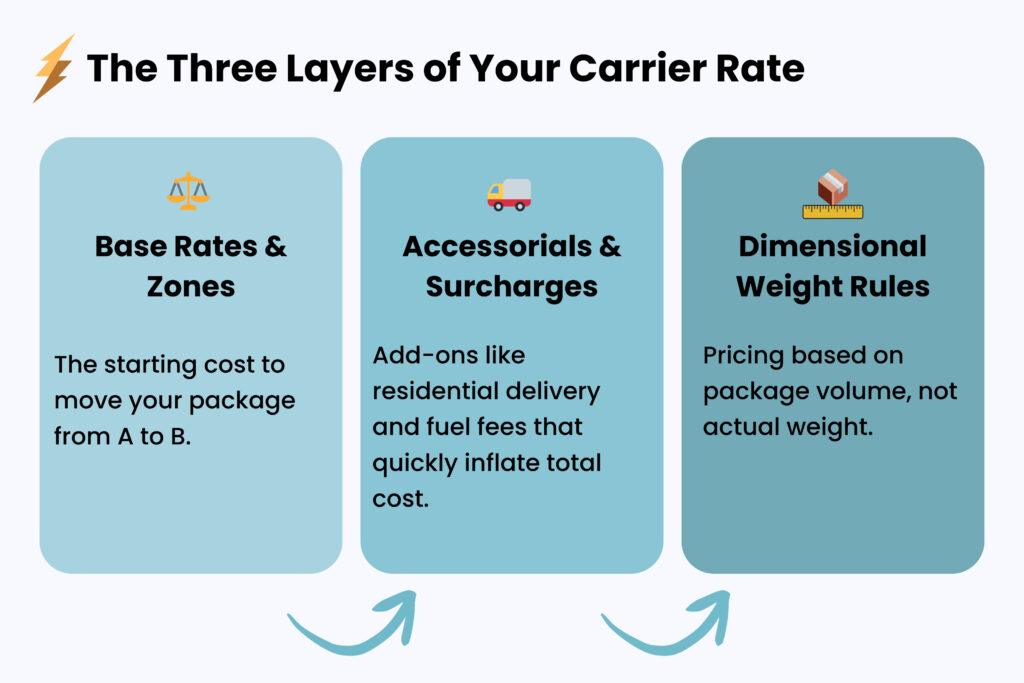

Every carrier rate card follows the same basic structure, but the devil lives in the details. What looks like a straightforward pricing document is actually a three-layer cost system designed to shift risk onto shippers.

What's Inside This Guide

What's Actually in a Carrier Rate

Understanding what you’re actually paying for starts with breaking down the three main components that determine your total shipping costs.

Base Rates and Zone Charges

Base rates represent the starting price for moving a package from point A to point B, calculated by billable weight and zone (distance). Zone 2 shipments cost less than Zone 8. Simple enough. But base rates rarely reflect what you’ll actually pay.

Accessorials and Surcharges: Where Costs Hide

This is where margins disappear. Residential delivery fees, address corrections, oversized handling, and fuel surcharges stack up fast. Jacob Lieberman, GoBolt’s Director of Connect & Head of Network Operations, recommends reviewing accessorials first during carrier rate negotiation.

Negotiate specific discounts that impact your unique package profile. For Big & Bulky brands, the Dim Divisor and Oversize Surcharge often matter more than your base rate.

Jacob Lieberman, GoBolt’s Director of Connect and Head of Network Operations

Dimensional Weight Rules and Restrictions

Carriers price by dimensional weight when it exceeds actual weight. Each carrier uses different divisors and conveyability thresholds. Pay attention to these restrictions. If your packages can’t move through automated sortation, you’ll pay additional handling fees on every shipment.

Most shippers walk into carrier rate negotiation asking for a blanket discount percentage. That’s like taking a shortcut you’ve never been on and hoping it saves time.

Negotiating Rates for Your Package Profile

Smart carrier rate negotiation isn’t about securing the biggest discount number. It’s about targeting the specific charges that hit your bottom line hardest.

Why Generic Discounts Leave Money on the Table

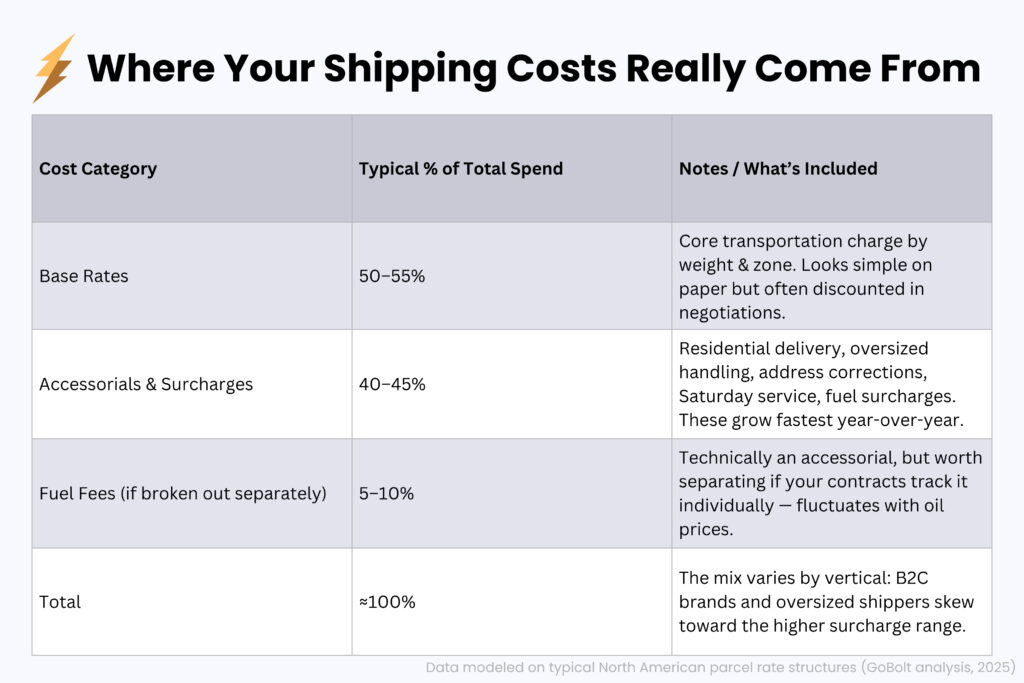

A 20% discount sounds great until you realize it applies to base rates while your real costs come from surcharges. If accessorials and residential fees make up 40% of your total spend, that blanket discount barely makes a dent.

Targeting the Right Line Items

Jacob Lieberman, Director of GoBolt’s Director of Connect and Head of Network Operations, recommends reviewing your accessorials and surcharges first. Then negotiate specific discounts that match your unique package profile. Shipping oversized furniture? Focus on the oversize surcharge. Heavy on residential deliveries? That’s your negotiating priority. Generic carrier rate cards treat every shipper the same, but your costs aren’t generic.

Dimensional Restrictions: The Conveyability Question

Pay attention to each carrier’s dimensional restrictions before you sign anything. Will your packages actually be conveyable on their network? Some carriers can’t handle certain package sizes regardless of what their rate card promises. That dream rate means nothing if half your shipments get rejected.

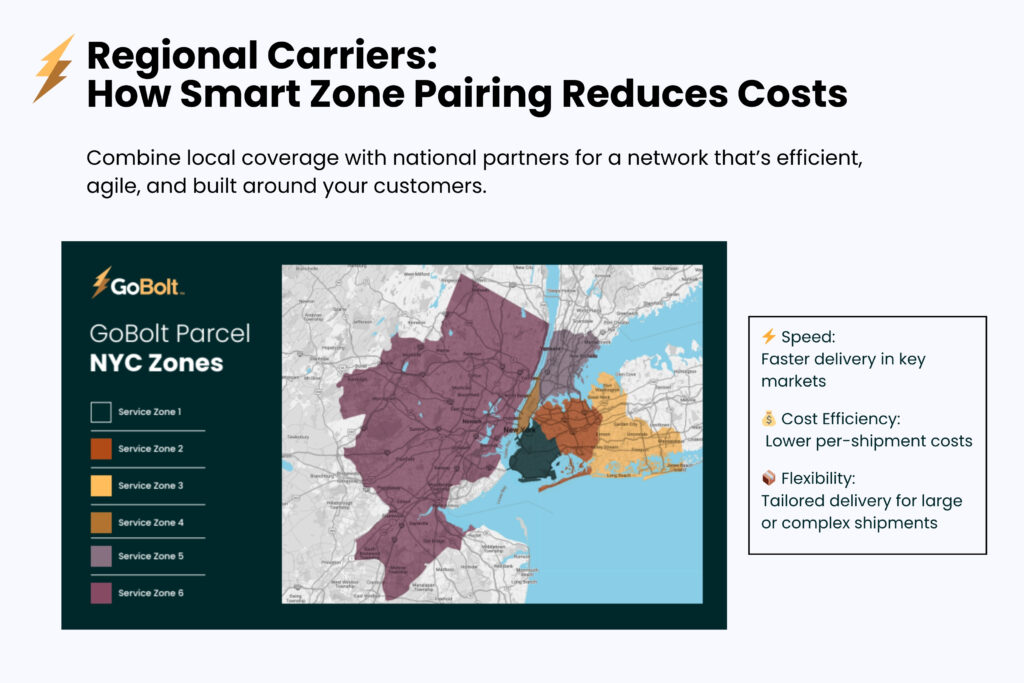

Regional carriers promise 20-30% savings on your carrier rate cards, and those numbers look great until you realize they only cover 50% of your delivery zones.

Regional Carriers: The Smart Cost Advantage

Regional carriers are increasingly proving that “smaller” can mean “smarter.” Their quoted rates often come in lower than national carriers, and when paired with the right logistics strategy, those savings can translate into meaningful cost efficiency and service improvements.

Strategic Coverage

Regional carriers shine in the zones they know best. Their focus on specific geographic regions allows them to offer faster delivery times, flexible service options, and a more personal touch. Before finalizing a partnership, it’s worth mapping your order data against their coverage area, not to find limits, but to uncover where they can deliver exceptional performance. For many shippers, pairing regional carriers with a complementary national network unlocks the best of both worlds: localized service and nationwide reach.

Smarter Handoff Economics

Because regional carriers often operate leaner networks, some may require first-mile coordination or a drop at their hub. However, these logistics can be optimized. Many businesses find that the added control over first-mile routing, combined with the efficiency and speed of regional delivery, leads to overall savings and better delivery experiences. By evaluating total landed cost rather than rate card alone, shippers often discover that regional carriers offer lower prices and a more agile, cost-effective shipping strategy.

Bridging Rate and Reality

While carrier rate cards provide a baseline, your real-world savings depend on how effectively you integrate regional carriers into your broader transportation mix. With smart routing technology and proactive planning, it’s possible to turn those quoted advantages into consistent cost reductions and service gains.

Real-Time Rate Adjustments and Technology Integration

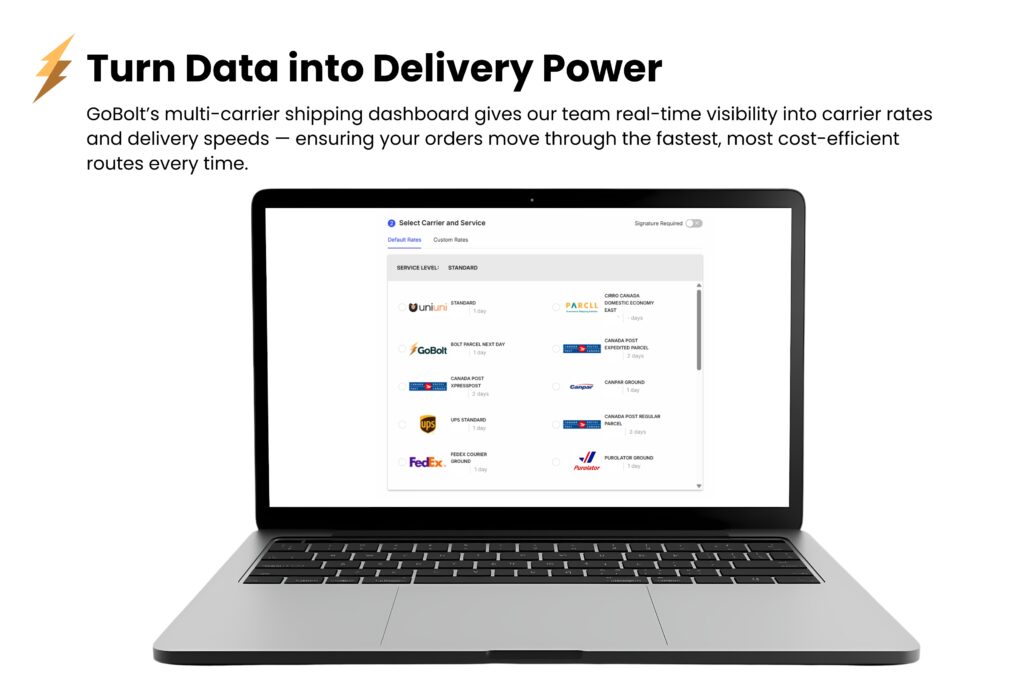

Modern shipping platforms compare live rates across carriers at checkout, but only if you’ve connected them properly and track what actually matters.

Rate Shopping Across Multiple Carriers

Platforms like Shopify let you add carrier-calculated shipping rates directly into checkout, pulling real-time quotes from multiple carriers simultaneously. The setup determines whether you’re showing accurate costs or losing margin on every order. Configure each carrier’s API credentials, set dimensional rules matching your package specs, and decide whether to pass full costs to customers or absorb the difference.

Tracking and Performance Metrics

Strong carrier tracking ensures packages send timely status updates from pickup through delivery—keeping customers informed and your support team free from chasing down updates. Regularly monitor on-time delivery rates, exceptions, and transit times across carriers to identify when low rates come with hidden performance trade-offs.

The Bottom Line

Carrier rates hide costs in accessorials, dimensional weight rules, and surcharges that can swing your logistics budget by 20-40%. Generic discounts on base rates miss the point when most of your actual spend comes from residential fees, oversized handling, and fuel surcharges. The shippers who control costs are the ones who match their negotiation strategy to their specific package profile and delivery patterns.

Here’s what you should do next:

- Pull six months of shipping data and calculate what percentage of your total costs come from accessorials versus base rates

- Map your customer addresses against regional carrier coverage areas to see if split-carrier strategies make financial sense after handoff costs

- Test your packages against each carrier’s dimensional weight divisors and conveyability thresholds before signing contracts

- Set up rate shopping technology that compares live quotes at checkout, then track carrier performance monthly to verify that low rates match acceptable service levels

Stop accepting rate cards at face value. Build your negotiation around the line items that hit your specific operation hardest, and you’ll recover the margin that most shippers leave on the table.

FAQ

📊 What's the difference between base rates and what I actually pay?

Base rates are just the starting point. Your actual costs come from accessorials and surcharges like residential delivery fees, address corrections, oversized handling, and fuel surcharges that stack on top. For many shippers, these add-ons make up 40% or more of total shipping spend, which is why focusing only on base rate discounts leaves money on the table.

🛋️ How should I negotiate carrier rates if I ship oversized or heavy items?

Target the specific surcharges that hit your shipments hardest instead of asking for a blanket discount. If you ship oversized furniture, negotiate the oversize surcharge specifically since that will impact your costs more than any base rate discount. Check dimensional restrictions before signing to make sure your packages are actually conveyable on their network.

💲 Are regional carriers worth it compared to national carriers?

When used strategically, regional carriers can be a powerful way to improve both cost and service. They often deliver 20–30% savings compared to national carriers, along with faster delivery times and a more flexible customer experience in the regions they serve best.

To get the most out of those savings, it’s important to understand your shipping profile. Compare your order data to a regional carrier’s coverage map to see where they can provide maximum value. Then, account for any first-mile or handoff costs — such as transporting packages to their hub — to get a clear picture of your total logistics cost.

In many cases, even after factoring in those logistics details, businesses find that regional carriers offer a winning balance of lower costs, faster service, and more personalized support.

❓ What tracking rate should I expect from my carriers?

A good carrier tracking rate starts at 95%, meaning nearly every package sends status updates from pickup through delivery. Below that threshold, you’ll spend time fielding customer support calls instead of letting automated tracking handle inquiries. Monitor on-time delivery percentage, exception rates, and transit times by carrier to catch when attractive rates come with poor performance.

⚖️ How do dimensional weight rules affect my shipping costs?

Carriers charge by dimensional weight when it exceeds actual weight, and each carrier uses different divisors and thresholds. If your packages can’t move through automated sortation because they exceed dimensional limits, you’ll pay additional handling fees on every shipment. This makes understanding each carrier’s specific dimensional restrictions critical before you commit to their rate card.